Overall Score: 7.1 / 10

Goal fulfillment

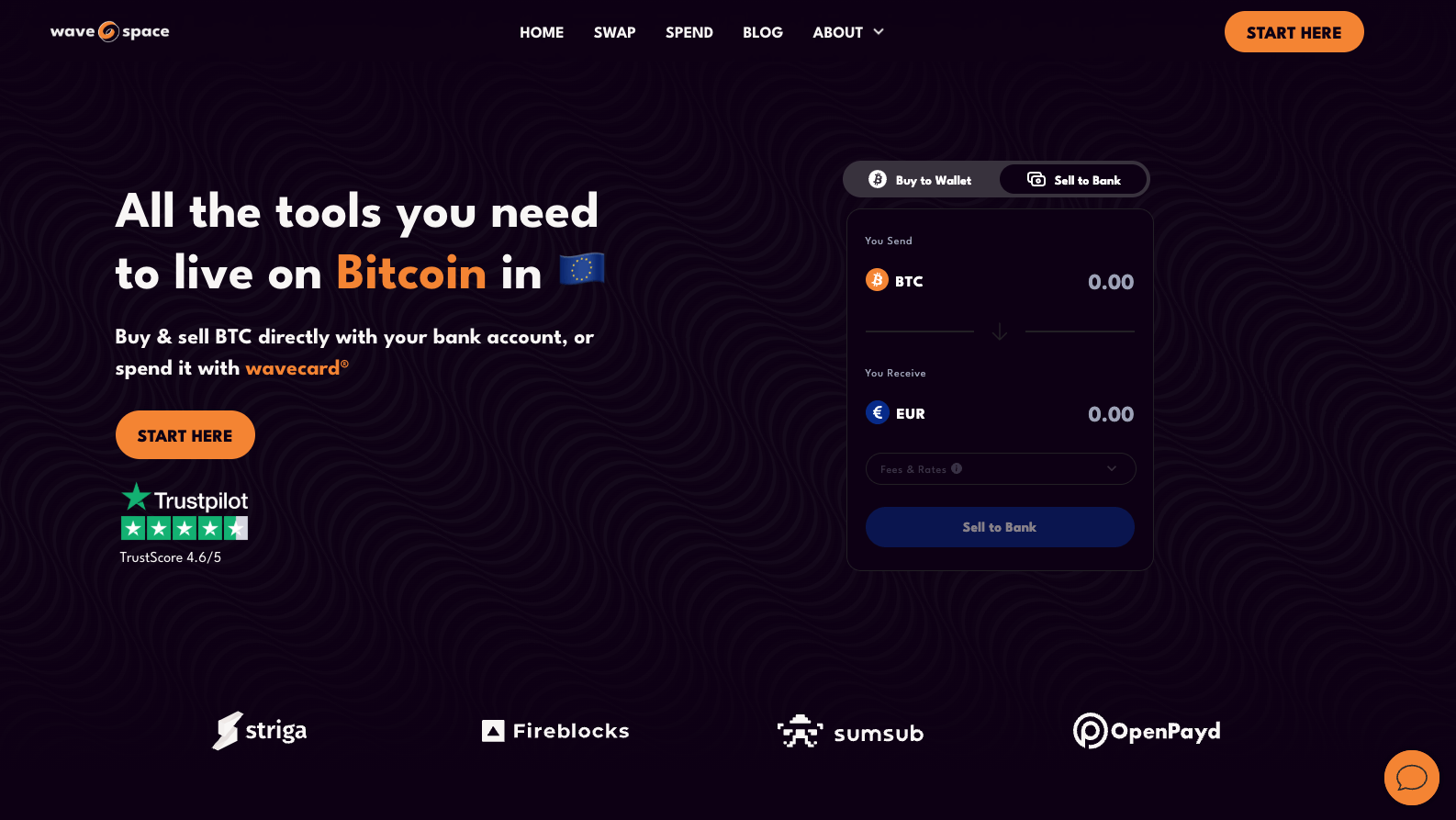

Today I’m going to check out the wave.space site, just because I have a personal interest in “living on the Bitcoin standard.” Because that’s exactly what wave.space promises.

When it comes to delivering and presenting this promise, the website really goes all out. They explain all the features they offer: you can swap Bitcoin straight to your bank account, you can spend with the Wavecard, you can buy Bitcoin with fiat, and they even show off their Trustpilot ratings.

So, living on the Bitcoin standard in Europe (“All the tools you need to live on Bitcoin in 🇪🇺”) — that’s the goal. Big goal. That’s why it caught my attention and I signed up. Let’s sum up what really needs to be in place for you to live completely without fiat in Europe and handle everything in Bitcoin.

- You need to be able to convert all your money into Bitcoin and back to fiat if needed.

- You need to be able to pay for all your purchases, even at a small corner shop.

- Every now and then you also need cash in hand. For things like parking meters or giving pocket money to your kids. You should also be able to withdraw cash at an ATM.

- You need to be able to pay your bills, ideally without roundabout solutions (Europe loves SEPA transfers).

- You should be able to pay for your online shopping and subscriptions.

And this all needs to work right from the moment they make the promise. So let’s see how much of that actually works with the Wavecard.

- Works. Conversion back and forth with a small fee and spread is available.

- Here’s where it gets tricky. The Wavecard isn’t a physical debit card, it’s virtual only. Sure, you can pay with Google Pay and contactless NFC, but only at places that accept it. In my big city in Germany, there are still plenty of shops that don’t. So, the promise is already broken here.

- Same goes for cash withdrawals at ATMs. With a virtual card, this is pretty much impossible.

- SEPA transfers directly to other people’s bank accounts? Nope, only to your own account, nowhere else.

- Works for online shopping and subscriptions with a virtual card and Google Pay (and they say Apple Pay is coming later).

So we’re already seeing that 3 out of the 5 points needed to live on Bitcoin aren’t covered.

If I had known that beforehand, I wouldn’t have bothered with the hassle of the KYC process. Every time I see “Sumsub,” their KYC provider, I just want to run away.

Sumsub requires a pretty basic computer or phone setup for user verification. Anything else, and they make it difficult. Like with VPNs. You start the process on your computer and then at some point you have to switch to your phone. You’re supposed to take a live photo of your ID, even if you already have recent photos stored somewhere. You’re not allowed to just upload them. Then they want a selfie, where you also have to stupidly rotate your head. It took me a while to figure out exactly how they wanted that rotation to happen.

And then, only once you’ve submitted your data and switched to your phone, it suddenly detects that you’re using a VPN and shuts everything down.

You turn off your VPN on your phone, but the thing still complains. Then it hit me — I already had a VPN running on my computer during the first half of the verification. So I turned that off too and started over. The whole process has to be done with a naked IP address; only then does it work.

Honestly, that’s absurdly pedantic. It was much easier, for example, with Bullbitcoin (in the EU) or Xapo Bank. KYC there was done in 3 minutes.

Because these services refuse to acknowledge that today’s internet users are operating with VPNs by default, they don’t give you an early warning — only much later. Even my home router is configured with a VPN; if my family wanted to use the service, they wouldn’t even be able to disable the VPN without me.

So instead of the 5 minutes they promise on the website, the KYC process took me more than 15 minutes.

At least wave.space itself doesn’t have a problem with VPNs, thankfully. Once I was verified, I contacted support and found out there that the card is virtual only.

The fact that there are no CSV exports (for tax reporting), apparently not until the end of this year, and that you can’t make transfers to external accounts — I only found that out on Nostr.

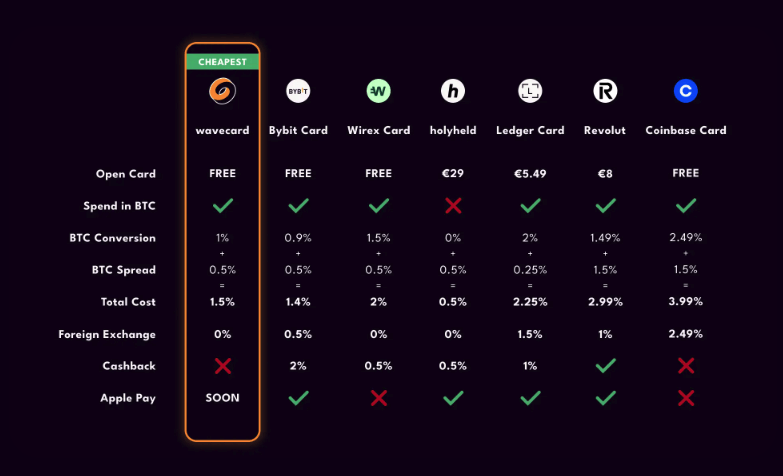

All in all, there are other providers in Europe that are closer to fulfilling the promise of “living with Bitcoin” than wave.space. A comparison table won’t help with that.

Not when important factors like a “physical card” or mobile app are missing from the comparison.

As I said, wave.space is still too early for such big promises. At least they have a roadmap on their homepage. But it doesn’t include the right milestones that would actually be necessary to fulfill that goal.

Score: 5/10

Technical appropriateness

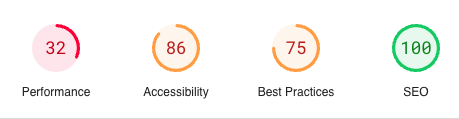

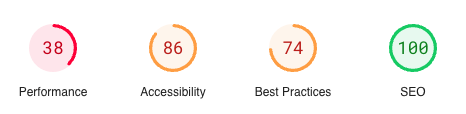

There’s nothing to complain about when it comes to the technical implementation, except for the fact that they’ve really gone overboard with 70 requests to 18 unique hosts as third-party embeds. Bitcoiners tend to be a pretty privacy-conscious bunch, so I’m not sure that’s going to go down well. But more on that later.

The fact that all these external resources cause loading time issues is also confirmed by PageSpeed Insights. Both on mobile:

And on desktop:

Score: 6/10

Visual Design

The design is top-notch, no doubt about it. All the fonts are legible, the colors are perfectly matched. It’s not easy to create a cohesive, modern design while working with that typical Bitcoin orange — but they’ve pulled it off here. Even the blue from the EU flag has been cleverly reused in other areas. The animation effects during page transitions are also first-class. The spacing is consistent everywhere. Excellent CSS craftsmanship!

Score: 10/10

Usability

The usability of the website is just as good. The swap interface in the customer area is self-explanatory, and the menu is simple but sufficient. The only point of criticism would be the “Start here” call-to-action button. It always says “Start here,” even if you’ve already started or are logged in. It could be renamed to “Customer Area” or “Launch App,” as it’s called in the mobile view, when logged in.

As mentioned above, the KYC process is tricky. Although it’s not directly part of wave.space, as a cooperation partner, it’s still tied to them in a way.

Score: 8/10

Accessibility

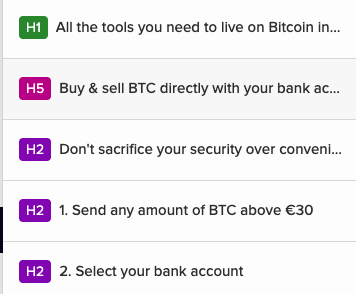

The website has good color contrasts and ARIA labels. But what’s with that H5 slip-up between the H1 and H2?

In the customer area, however, there are no headings at all.

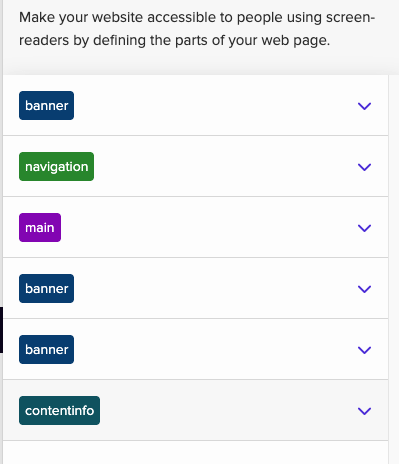

Landmarks are set correctly.

But all the images are set as decorative, meaning they can’t have alt attributes, even if they convey information.

Does a visually impaired user even know which website they are on? What the name of the website is?

Score: 7/10

Communication design

The tone and communication style are appropriate. If only that big promise mentioned above wouldn’t remain unfulfilled. Because that’s also part of communication.

Score: 8/10

Ethical Analysis

As mentioned under “technical appropriateness,” many third-party resources have been embedded. From Google and DoubleClick to Twitter, there’s a lot involved. Most of them aren’t even mentioned in the privacy policy. The policy itself is quite short, so it can’t possibly be complete.

And am I right in thinking there’s no cookie consent banner? And with so many third-party embeds, including from privacy-unsafe countries like the USA? In Europe? That’s a dangerous game being played.

The team and the responsible parties are clearly identified. But I can’t judge whether the legal provider identification requirements in Lithuania have been properly met. I’d suggest asking someone knowledgeable in law.

Conclusion: There’s a clear intent for transparency in provider identification, but the undisclosed third-party resources should still be problematic in Lithuania, which is also bound by GDPR.

Score: 6/10

Overall Score: 7.1 / 10

0 Comments